Welcome back to The 2x2 - the ultimate newsletter for executive consultants!

Preparing for a board meeting? It’s a different league out there.

Good thing we have Ryan O’Toole to make better sense of PE boards for us.

Read on…

⏰ Today in 5 minutes or less:

Boards play different roles depending on the stage of the company’s growth.

Everyone in the board has a financial stake, but all of them have different incentives to be there.

Boards care less about detail and execution — but more about clarity and direction.

Walk Into the Board Room with Ryan O’Toole

Every consultant can build a deck. But only a few can run the room.

Independent Operating Advisor Ryan O’Toole spent his entire career inside rooms a lot of us only hear about – PE board rooms and PE-backed leadership teams.

He’s been the consultant, the operator, and the advisor.

This makes him unusually good at explaining how boards actually work.

In this interview, we’re talking about everything you and I need to know about PE boards.

I realized recently that there are different types of boards with very different objectives. Can you break down the landscape a bit – how do these boards differ?

Ryan: I think the one people are most familiar with are public company boards. Those are governed by the SEC and tend to focus heavily on governance, risk management, and compliance. The discussions are usually higher level and less operational.

Next are privately held company boards, which are often more about guidance and accountability. We also have advisory boards which tend to show up in earlier-stage companies – those are about credibility, connections, and awareness instead of governance.

I’ve spent a lot of my time with PE-backed boards, where many mid-market companies sit. You usually have a deal team involved, operating partners or advisors, and sometimes independent board members.

There are also important dynamics around majority and minority control – who has decision-making authority and how that plays out in the room.

Boards play very different roles depending on the stage of the company and where it is on its lifecycle. PE boards in particular are more focused on execution, making sure that the company is delivering the investment thesis within a defined time horizon.

Can you walk through who’s actually in a PE board room and why they’re there?

Ryan: In a private-equity context, you’ll usually have one or two people from the deal team, an operating partner, and independent board members.

People from the deal team are usually at a principal or equivalent level. They’ve been at the firm for five to seven years, helped find the deal, and were heavily involved in underwriting it. They don’t have a huge portfolio, but each deal matters a lot.

You’ll usually also have a more senior deal partner so builds the relationship with bankers and sellers. They’re someone who’s been around the block.

Next, you have an operating partner or an operating advisor – someone who’s been a CEO, CFO, or senior operator before. They’re there for pattern recognition. They know how situations play out in real life.

Finally, you may have independent board members. They are external advisors with deep industry experience or valuable networks. Sometimes they’re there to help with credibility or strategic connections – but often they want to keep their minds engaged and give back by mentoring.

Everyone has a financial stake, but it’s not the same for everyone.

For some people, it’s career-defining. For others, it’s upside or intellectual engagement.

Understanding that mix is really important, because it explains why people ask the questions they ask and push on the things they push on.

One mistake I see is assuming deal people only care about numbers and don’t understand operations. But financial stakes aren’t their only incentive.

Some members actually often know the market, thesis, and diligence better than almost anyone else because they’ve spent hundreds of hours on it.

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

For those of us who haven’t dealt much with private-equity boards, it can feel like a black box. At a very basic level, what is the real objective of board meetings?

Ryan: If I think about a private-equity–backed board in its simplest terms, it’s really about one question: are we on track to deliver on the thesis that we underwrote?

Typically, you have quarterly board meetings with the full board because they want to know:

How are we doing?

What’s next?

Are we on track?

And most importantly, how can we help?

You’ll also have monthly financial reviews where you go through performance and sometimes major strategic initiatives. Different PE firms have very different levels of involvement. The deeper they know about the industry, the more they’re operationally engaged.

Another thing to consider is that board meetings are one of the only times they meet the leadership team. This means they’re not just evaluating results, they’re also asking themselves:

Do I trust this team?

Do I have the right leaders in place to deliver the thesis?

There’s always a balance between detail and perspective.

Some teams go very deeply into the details of the project, but the board wants to step back and understand the direction given the time constraints and exit they’re working towards.

You’ve been on both sides of this – as an operator and as an advisor. When you walk into a board meeting, how do you take advantage of the room effectively?

Ryan: The first thing I think about is what a great outcome of the meeting would be. If you think about what you want to walk out with, it changes everything about how you prepare and how you show up.

With the deal team, what we’re discussing impacts the numbers, the exit path, and the glide path to sale. There’s usually a three- to five-year window, so what does the business need to look like to be attractive to the next buyer?

They might also have strong views on trade-offs – maybe they’re okay sacrificing some EBITDA for growth at one point in the cycle, but not at another.

Operating partners bring pattern recognition. They’ve seen similar situations across multiple companies. They often have close relationships with the CEO and understand what’s really happening on the ground.

External board members often have deep customer or industry insight. If you’re trying to sell into a specific type of organization, and someone on the board used to run procurement there, that’s incredibly valuable. But you only get that value if you invite it.

A big mistake people make is treating board meetings as performances.

They think, “I need to present, look smart, and defend my work.”

Instead, the mindset should be, “We’ve done the work. Now, let’s use the collective experience in the room to make it better.”

Most people also don’t engage board members between meetings, which is a missed opportunity. Board meetings shouldn’t be the first time someone sees an idea, especially if it’s controversial.

Finally, clarity matters more than being right.

The worst thing you can leave a board meeting with is confusion about direction. If you walk out with more clarity and fewer priorities, that’s success. If you walk out with more things to do and less alignment, something went wrong.

Great board meetings create focus – which is incredibly hard when you’re trying to double or triple the value of a company in a few short years.

What We Can Learn from Ryan O’Toole:

Your job is creating clarity. Senior clients don’t need more analysis – they need help deciding what matters most at the moment. You need to end meetings with fewer priorities and clear next steps.

Pay attention to incentives. People in a board meeting care about different things for good reasons and ignoring that is how you get ideas rejected. Frame your advice in a way that matches what each person is accountable for, not just what you think is right.

Always prepare for the outcome you want. Most of the value happens before the meeting, when you decide what success looks like and where alignment is needed. Slides are the tool, but the real work is guiding the conversation to a decision

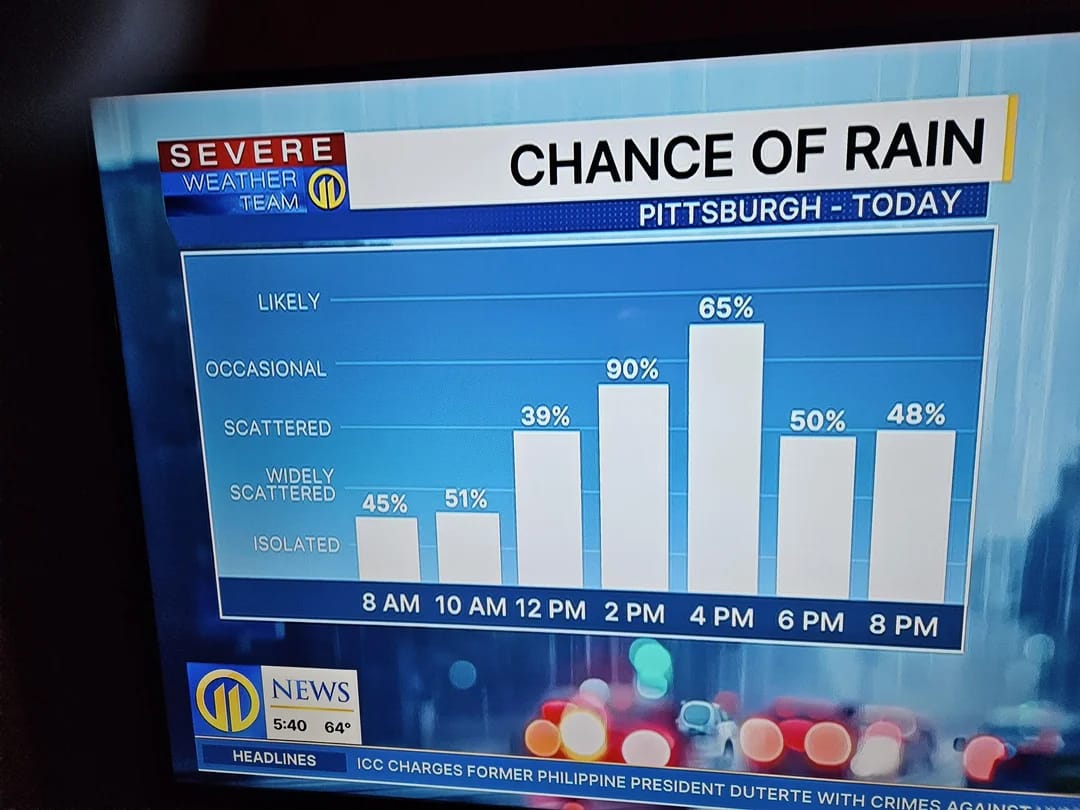

Chart Crimes: Rain Check

🚨 Chart crimes!

This bar graph needs a rain check.

Remember, the path to success is paved with continuous learning and embracing fresh perspectives.

Let's stay connected, share ideas, and elevate your consulting business.

Stay curious, friends.

The 2×2 is brought to you by Keenan Reid Strategies

Having trouble viewing this email? Check out this and past issues on our website.

Was this newsletter forwarded? Someone is looking out for you. You should definitely subscribe!